October 31, 2013

2013 Review of Intuit EasyAcct Laser Link – W2/1099

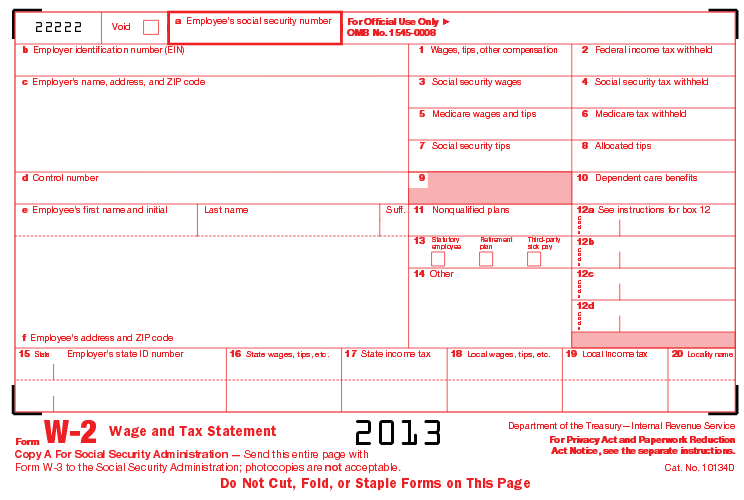

Intuit EasyACCT is a comprehensive write-up solution for accountants. It allows users to manage the processes for write-up, accounts receivable and payable, payroll, bank reconciliation, asset depreciation and financial reporting. It supports SUTA, 940, 941, W-2 and 1099 forms, automatically e-filing with the IRS. Users can also manage live and after-the-fact payroll. Basic System Functions...…