Taxes July 31, 2025

New Federal School Voucher Program Poses a Quandary for States: Opt In or Opt Out?

A tax credit in Trump’s signature law leaves states to sort out rules, funding, and oversight.

Taxes July 31, 2025

A tax credit in Trump’s signature law leaves states to sort out rules, funding, and oversight.

Taxes March 18, 2025

With key Tax Cuts and Jobs Act provisions set to expire at the end of this year, most Certified Financial Planner professionals say clients' retirement and financial plans could be at risk, according to new research by the CFP Board.

Legislation March 12, 2025

But with most Democrats opposed and 60 votes needed in the Senate to avoid a filibuster, it is unclear if the measure has the support needed in that chamber to pass.

Taxes February 26, 2025

Chances for early action on Donald Trump's tax cut plans improved as House Republicans passed a budget blueprint Tuesday calling for deep cuts in safety-net programs such as Medicaid.

Taxes February 20, 2025

No one can say with certainty but lawmakers are hopeful that the partisan bickering that's dominated Washington debate will subside on the disaster tax relief issue.

Taxes February 19, 2025

The quarter percent federal excise tax, also known as the handle tax, "does nothing except penalize legal gaming operators for creating thousands of jobs," said U.S. Rep. Dina Titus, D-Las Vegas.

Taxes February 15, 2025

The CPA Practice Advisor Weekly Tax News Roundup is a weekly recap of tax-related news from the past week. From IRS news and tax court cases, to state, SALT, legislation and other related areas, the roundup can help you catch-up on recent changes. === Let us know if you like this new feature using the...…

Taxes February 11, 2025

Ford Motor Co. CEO Jim Farley warned that if the federal government under President Trump repeals provisions of the Biden administration's Inflation Reduction Act like the electric vehicle battery production tax credits, the company could have to look at layoffs.

Taxes January 31, 2025

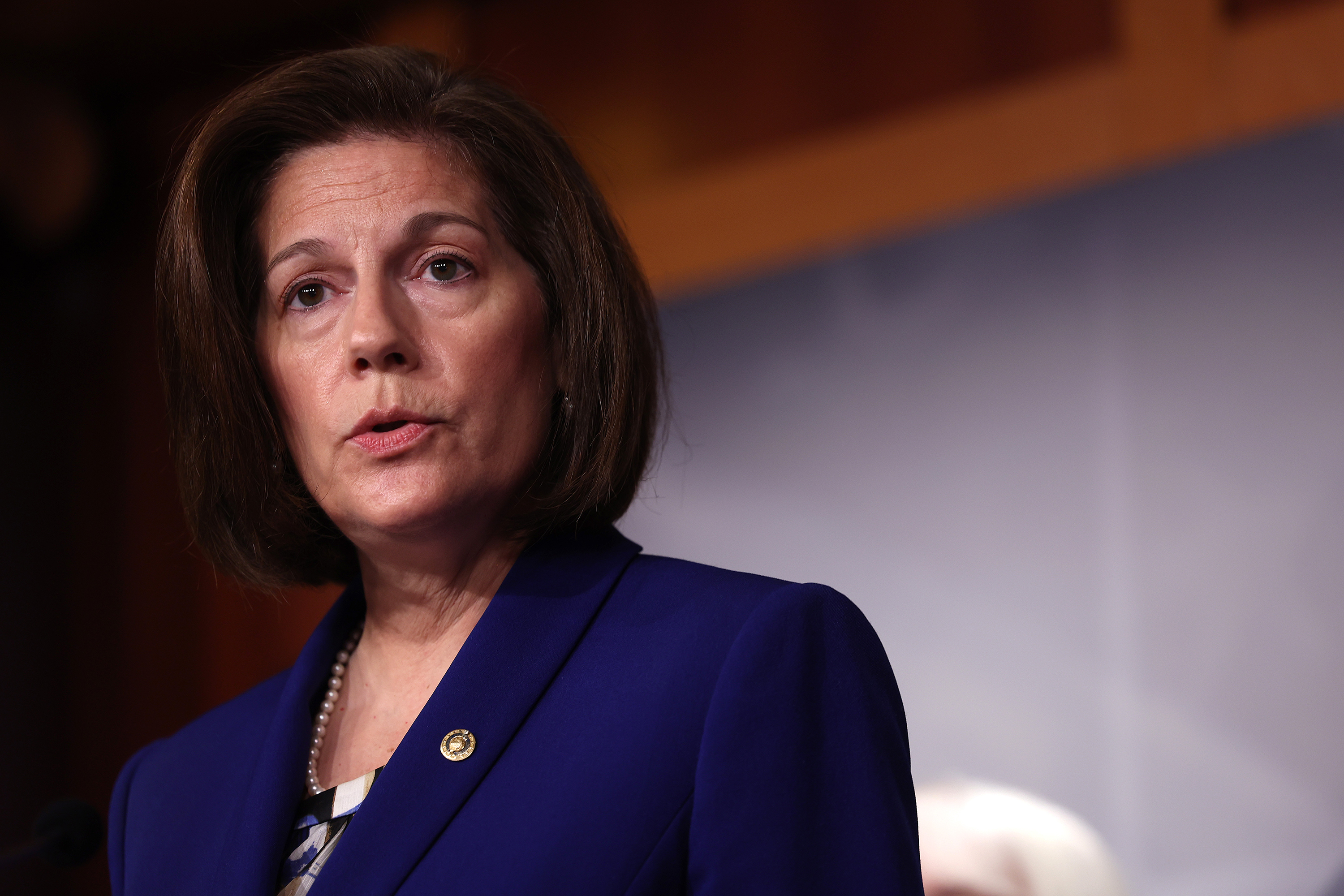

Senate Finance Committee members Catherine Cortez Masto (D-Nev.) and John Cornyn (R-Texas) introduced legislation Thursday to stop companies from deducting or claiming credits on their U.S. tax bills for taxes paid to Russia.

IRS January 30, 2025

A discussion draft, released Thursday by Sens. Mike Crapo (R-ID) and Ron Wyden (D-OR), that proposes several ways to fix IRS procedures and administration has strong support from National Taxpayer Advocate Erin Collins and the AICPA.

Taxes January 22, 2025

Sen. Bernie Moreno, a newly elected Ohio Republican, introduced his first piece of legislation on Tuesday—a bill aimed at funding the External Revenue Service that President Donald Trump has promised to create.

Taxes January 21, 2025

With President Donald Trump back in the White House for a second term, Americans can expect to see major tax law changes in the years ahead.

Taxes January 17, 2025

Taxes and tariffs took center stage Thursday at a hearing for President-elect Donald Trump's intended Treasury secretary nominee Scott Bessent.