Small Business July 17, 2025

Back-to-School Season Gets Early Start

The early start is up from 55% last year and is the highest since NRF started tracking early shopping in 2018.

Small Business July 17, 2025

The early start is up from 55% last year and is the highest since NRF started tracking early shopping in 2018.

May 4, 2016

Despite the years that have passed since the financial crisis known as the Great Recession, many retirees are still feeling its aftereffects. A new survey from the nonprofit Transamerica Center for Retirement Studies (TCRS) finds that only 45 percent of retirees say that they have either fully financially recovered or were not impacted. Thirty-five percent...…

May 2, 2016

80 percent of respondents said that credit scores were important. When asked what attributes were important in a spouse, 92 percent of survey respondents said financial responsibility.

April 26, 2016

The path to achieving financial milestones like paying for a college education, buying a car, owning a home and retiring at an early age always begins with one step: saving for the future.

April 25, 2016

The study found that 73 percent like to do research on their own before making financial decisions, 58 percent rely on financial advice from professionals, and 56 percent trust digital finance advice.

April 25, 2016

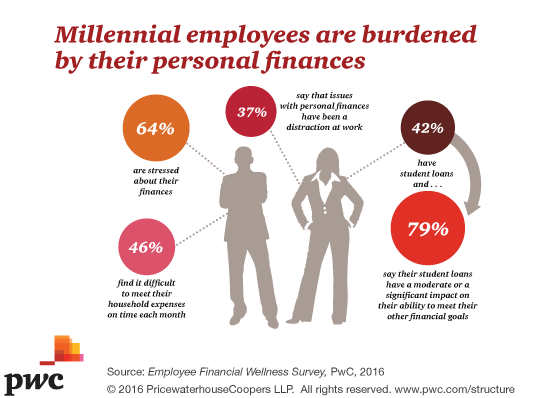

A new report from PwC shows that Millennials may be more stressed about their financial situations than any other generation.

April 18, 2016

The mobile-friendly calculator was developed to address the top four financial concerns of consumers found in MassMutual’s State of the Hispanic American Family study: income, savings, retirement and debt. The calculator addresses each financial ...

April 5, 2016

As further evidence that the role of CFO is becoming less tactical and more strategic, the survey found that only 8% of CFOs, or teams reporting directly to the CFO, are spending the bulk of their time closing the books each month. By contrast, the ...

April 5, 2016

Thomson Reuters Checkpoint Financial Management and Controllership combines expert analysis and practical, day-to-day guidance for financial managers and controllers, incorporating sample statements, budgets, disclosures, customizable checklists, ...

April 3, 2016

Forty-seven percent of respondents frequently live paycheck to paycheck. Two-thirds2 of Americans don't have six months of savings in their emergency fund. Thirty percent don't have an emergency fund at all. More than half of respondents don't ...

March 28, 2016

Over half (55 percent) of the young adults surveyed admitted that they were impulse shoppers, defined as making an unplanned purchase of $30 or more on a daily or weekly basis. Impulse buyers are more likely than those who never or rarely make an ...

March 21, 2016

It's important to have a track to run on when it comes to retirement planning, but you may want to exercise a bit of caution in putting too much weight on these financial-planning rules.

March 21, 2016

To grow your business valuation services, consider helping your clients learn how to treat their business like an investment. Doing so can generate repeat valuation engagements while boosting your role as a trusted advisor.