Payroll July 29, 2025

Social Security Makes Major Decision for Beneficiaries Who Receive Paper Checks

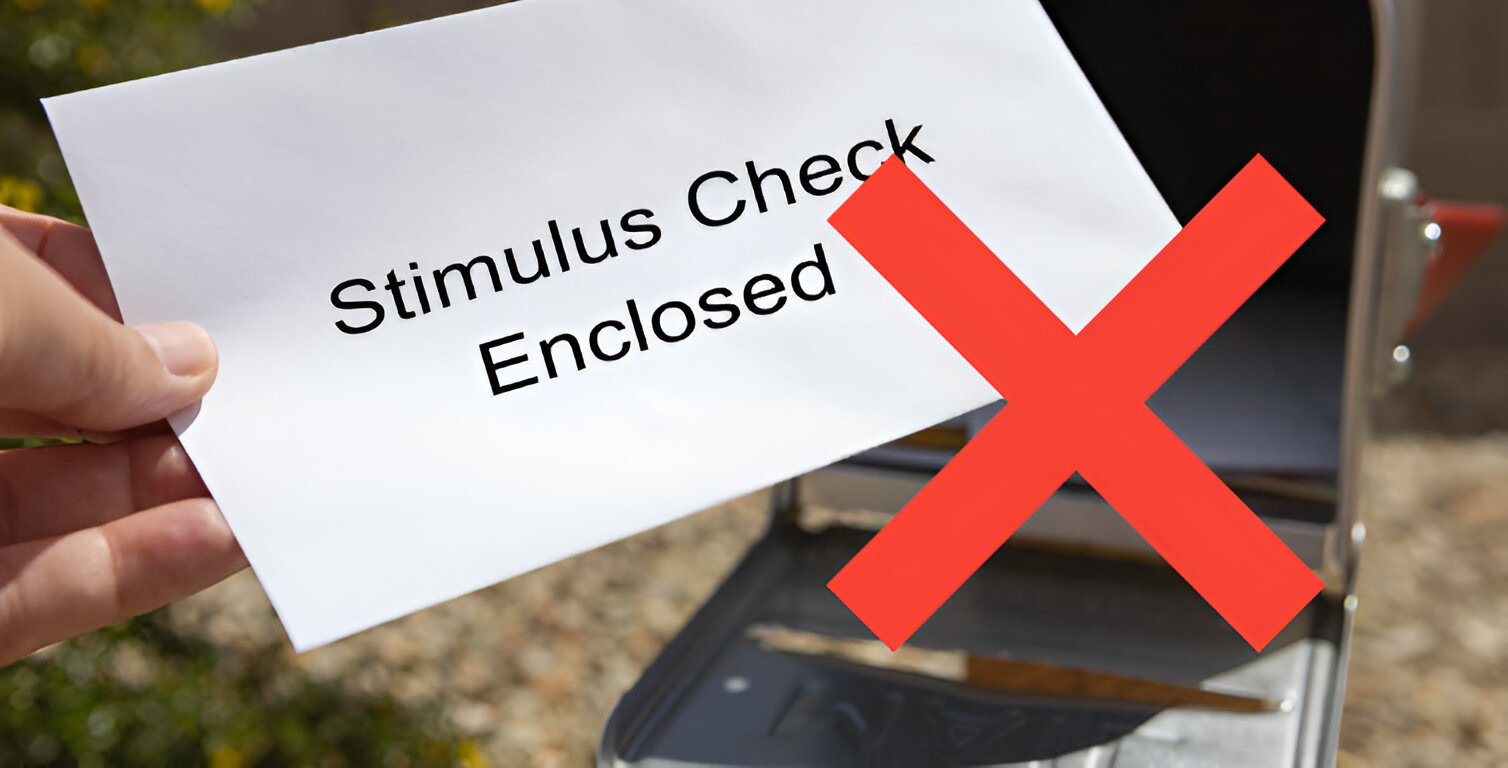

The Social Security Administration is backing away from a plan that would have eliminated paper checks for benefit payments issued to beneficiaries.